Build Your Future on a Cornerstone

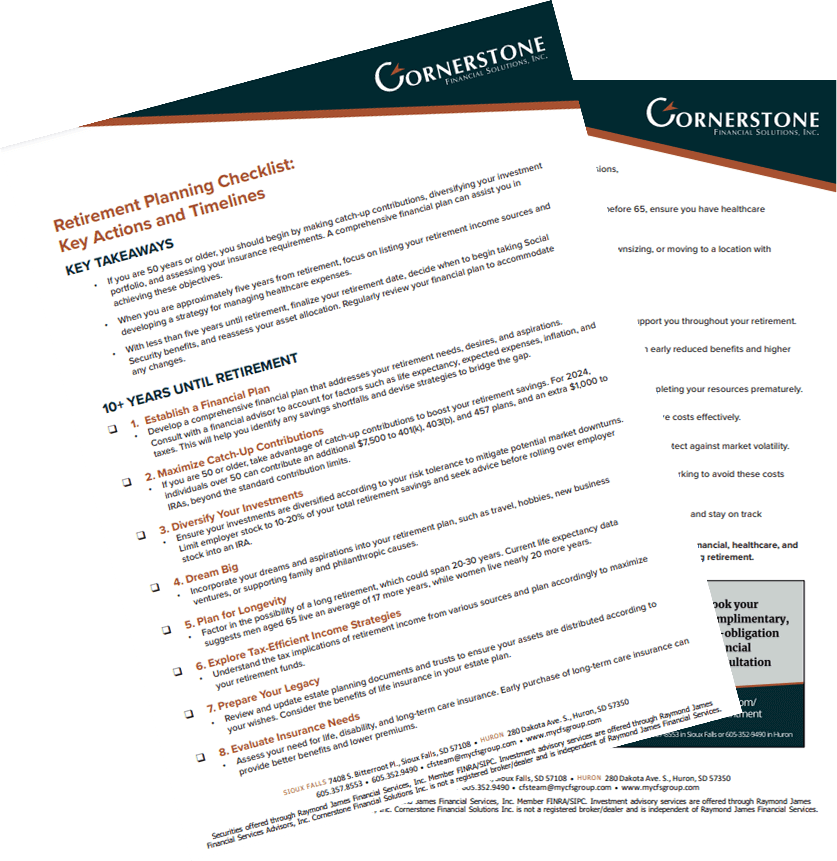

Start with a Solid Foundation, Download Our Retirement Planning Checklist

Whether you are just starting your retirement journey, or already have a plan in place, this checklist provides a structured approach to preparing for retirement including essential financial, healthcare, and lifestyle considerations.

The Cornerstone Experience®

We’re here to empower individuals to discover and pursue their true potential in terms of wealth, business, and life. Our personalized approach highlights how financial planning can impact individuals, their families, and future generations, helping them to achieve their dreams. Connect with us to learn more about leaving your lasting legacy with The Cornerstone Experience®.

Cornerstone Insights

6 Truths About Working With a Wealth Advisor

You’ve worked hard for your money and choosing who to trust with your finances is a big decision. Learn the benefits of working with a professional.

The Family Meeting

Discover how a professionally facilitated, well-planned family meeting can help keep your family’s financial future on track.

5 Steps to Determine How Much Income You’ll Need in Retirement

The problem with determining your desired annual retirement income as a percentage of your current income is that it doesn’t account for your specific situation. For example, if you want to travel extensively in retirement you might easily need 100% (or more) of your current income to get by.

Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance does not guarantee future results. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the

appropriate professional.

Subscribe to our Weekly Market Update

Getting the Relationship You Deserve

Choosing who to trust with something as significant as financial management can be daunting. Beyond the numbers, it’s about understanding, history, and familiarity.

To help make your decision feel less like a leap into the unknown and more like the seamless transition to a trusted advisor it should be, we’ve created a free interview guide to help you track, compare, and evaluate financial planners.

Our team’s mission is to earn your life-long trust by helping you simplify and confidently make wise financial decisions.

Your Plan Can Create Meaningful Outcomes In Your Life

Our team will analyze your income needs for today and tomorrow, then help you develop and implement a plan to help you achieve the life you’ve imagined in retirement.

Retirement Planning

Gain confidence with goal setting and monitoring, comparing scenarios to understand how factors impact your plan.

Estate & Charitable Planning

A basic understanding of estate planning can help you preserve your assets, take care of the people who are important to you, potentially reduce taxes, and avoid common mistakes.

Tax Planning Strategies

Keeping your tax liability to a minimum is an essential part of maintaining your Cornerstone financial plan.

Investment Management

Our advisors will help design a strategy that is clearly defined, matches your goals, and aligns with your risk preferences and lifestyle.

Risk Management / Insurance Planning

We use best financial practices, built on an industry-renowned framework, to help us understand YOUR acceptable levels of risk-and-reward with unparalleled accuracy.

Hear Directly From Our Team

❝

I was immediately drawn to the team and atmosphere at Cornerstone. With my first step in the door, I felt accepted, seen, and valued. I am proud to be part of an organization that truly believes in placing people over profit.

Shelby Bierema

Manager of Client Relations, FPQP®

❝

It wasn’t about sales; it wasn’t about money. Cornerstone displayed a genuine love for their clients and I knew it was something I wanted to be a part of.

Andrew Ulvestad

Wealth Advisor, AAMS®